The Case for a Mild Slowing in 2023. Semiconductor Cyclicality.

G. Dan Hutcheson

The Chip Insider®

The Case for a Mild Slowing in 2023: It is always a red flag whenever there is a wide range of forecasts from forecasters… Current semiconductor forecasts for 2023 are ranging in the negative between low-single digits and -20-plus percent. My personal belief is it will be in the low-single digits with a high potential for an upside surprise. But first, let’s review a cyclical history of the semiconductor industry to get a better understanding of why this is the likely case…

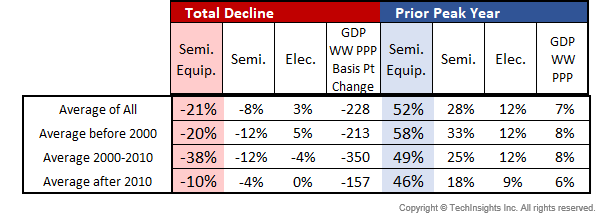

Cyclical History of the Semiconductor Industry: There have been 13 recessive growth periods since the Integrated Circuit market emerged in 1963. That’s an average of one every 4.5 years. There have been 6 since 2000, for an average of 3.7 years. The average semiconductor downturn since 1963 is -8%. For equipment it’s -21%. The range has deviated from -56% to +12%…

The Case for a Mild Slowing in 2023 Continued: Hopefully, you’ve read the above to understand why a -20% decline in semiconductor sales is unlikely based on structural changes in the semiconductor industry. While the number of cycles across the decades are relatively few, the magnitude has declined since 2010… Superior inventory control on … A similar reduction in semiconductor industry volatility can be seen in semiconductor sales, with the notable exception being the 2008-10 Financial Crisis that was really from outside the semiconductor industry’s infrastructure. So a classic capacity/inventory cycle was not the cause … The bottom line is that … I’m finding it hard to be really negative.

“If you don’t like what’s being said, change the conversation” — Don Draper, Mad Men

“Forecasting is difficult… Especially when it's about the future” – Yogi Berra

Click here to get more information about Semiconductor Chip Market Research Services

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view more articles in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.