It's cooling off and the leaves are turning yellow

Andrea Lati

- Order activity for semiconductor equipment continued to cool off, slipping by nearly two points in the first week of October

- All segments ended the week lower as chipmakers grow more cautious about their near-term prospects

- Memory fundamentals have deteriorated considerably over the last few months, pressuring chipmakers to cut spending and trim utilization rates in order to reduce supply and digest soaring inventories

- The ongoing correction in the memory market is not surprising—we have been warning of a deteriorating market backdrop since late April—however, the magnitude of the correction is steeper than expected

- The logic market is also encountering headwinds on multiple fronts and is expected to slow down even more in Q4

- On the equipment side, Assembly and Test manufacturers have already felt the impact of a slowing semiconductor market in 2H22, while WFE suppliers have been somewhat insulated due to strong bookings and long lead times

- We expect the WFE sales to come under pressure in 2023 as the semiconductor industry works through the excesses of the COVID-19 phase

- TechInsights’ Chip Price Performance Index continued to trend lower

- DRAM fell

- NAND flat

- MPUs fell

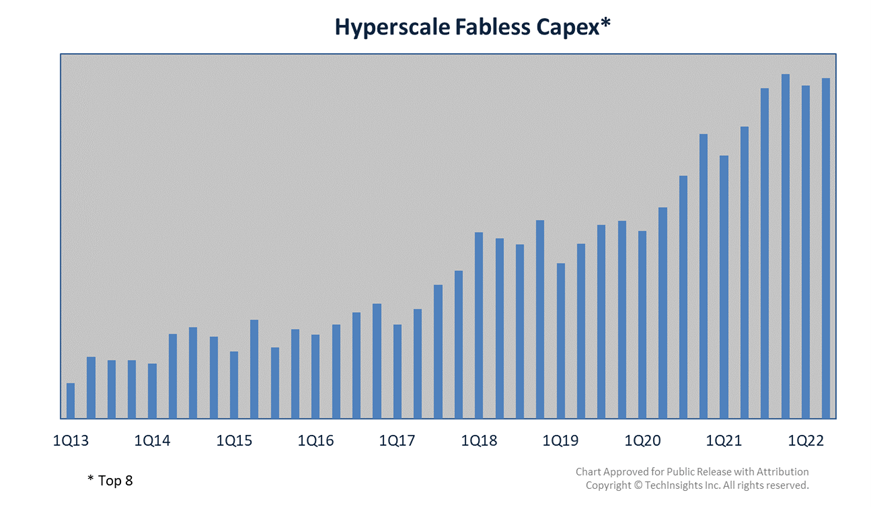

- Hyperscale Fabless Capex is still growing on yearly basis, but the pace is slowing

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.