IC Supply/demand Tightens

G. Dan Hutcheson

Semiconductor Analytics

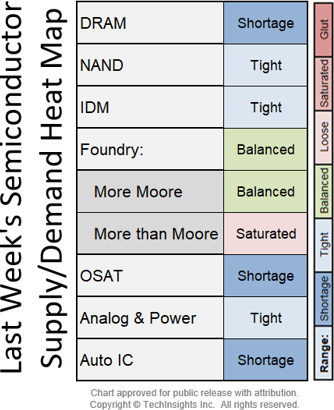

Semiconductor sales continued to explode out of the normal Christmas roll-over with double-digit W/W and Y/Y growth, as IC Supply/Demand tightened up. The IC weather warmed 2°F last week. VLSI's IC Supply/Demand indices tightened last week, with OSATs moving back to Shortage, while More Moore Foundry tightened up to Balanced and More than Moore to Loose. DRAM and Auto ICs held in Shortage, with NAND, IDM, and Analog & Power at Tight levels.

Semiconductor Sales growth continued to head down to historic trend rates, even though they remain at thin-oxygen 13-week MA heights. 2021 was a hot year for sales, which have been up and to the right since March of 2021 reaching $0.6T and on track, at a 6% CAGR, to hit $1T by 2030.

Zooming in on NAND this week the 13-wk MA growth dipped towards 25%, the lowest since September. The 2022 NAND forecast is for sales to almost hit $70B and grow at 17%. Last week, Logic was passed by DRAM for the title of the fastest W/W growth with Analog & Power a close third. NAND was slow. Auto ICs actually declined and growth was low on a Y/Y basis - an indication of the shortage ending for the bulk of the market.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.