Semiconductor Sales Pull Back

G. Dan Hutcheson

Semiconductor Analytics

Semiconductor sales pulled back 5% W/W in a typical early February dip. The IC weather warmed 1°F last week. Semiconductor Sales growth continued to hover above the 20% Y/Y bar. This is well above last year's levels at this time.

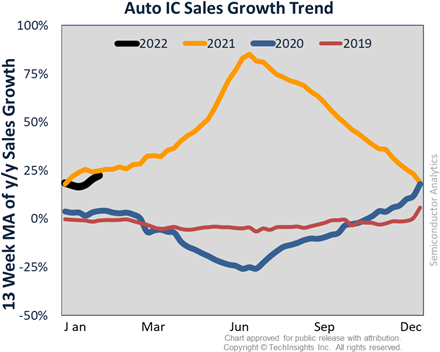

Zooming in on Auto ICs this week, after falling through the second-half of 2021 off an 85% peak, 13-wk MA growth bounced off 15% levels in early January and has risen above 20%. TechInsights' 2022 Forecast for the segment has sales passing $33B and growing at 16%.

TechInsights' IC Supply/Demand indices loosened last week, with Foundry dropping to Saturated. Unchanged were DRAM, NAND, IDM, OSAT, Auto IC, and Analog & Power at Tight. With the Lunar New Year behind, the loosening is likely seasonal and not a sign of weak demand or over capacity. That said, the stark difference between foundry and the other sectors may be a sign of worse things to come.

Electronics' Retail Prices continue to soar.

Free Newsletter

Get the latest analysis of new developments in semiconductor market and research analysis.

Subscribers can view the full article in the TechInsights Platform.

You must be a subscriber to access the Manufacturing Analysis reports & services.

If you are not a subscriber, you should be! Enter your email below to contact us about access.