Chip Observer June 2025

Navigating Geopolitics, AI, and Semiconductor Innovation

From shifting tariffs and bold AI investments to breakthrough chip designs and industry shakeups—get exclusive insights shaping the future of semiconductors.

6 Min Read June 20, 2025 Access the Full Report

The June 2025 edition of Chip Observer spotlights the key forces reshaping the semiconductor industry. Highlights include a paused US tariff ruling, a fragile trade deal with China, and major moves from Qualcomm, OpenAI, and AMD. We also examine the growing role of hybrid bonding in 3D integration and mounting pressures in the SiC market.

This issue features the latest McClean Report supplier rankings, insights from the 2025 Customer Satisfaction Survey, and a closer look at Advantest’s continued leadership in test.

Delve into the data, trends, and expert analysis driving the semiconductor industry forward.

What’s Inside the June 2025 Issue

-

Industry Observatory

June saw key shifts across trade, AI, and semiconductor manufacturing. A US court ruling on tariffs was paused on appeal, while the US and China reached a deal to resume rare earth exports. Qualcomm’s $2.4B bid for Alphawave was accepted, OpenAI acquired a start-up led by Jony Ive, and AMD absorbed most of Untether AI’s team. Huawei’s Kirin X90 is rumored to use SMIC’s 5nm process, and Xiaomi began mass-producing its 3nm SoC. IBM is adopting Deca’s packaging tech, and Intel and SoftBank launched Saimemory to develop stacked DRAM — track how global policy, AI, and advanced manufacturing are converging to shape the next phase of the chip industry. -

Under the Microscope

A paused US court ruling on Executive tariff powers and a time-limited rare earth export deal with China added fresh uncertainty to global supply chains. Qualcomm’s Alphawave acquisition progressed, OpenAI picked up a stealth hardware start-up, and AMD absorbed Untether AI. NVIDIA announced a 1 MW server rack initiative, while Huawei and Xiaomi advanced next-gen SoCs. IBM, Intel, and SoftBank pushed forward on memory and packaging, and M&A activity continued with IonQ, Qualcomm, and SoftBank all making strategic moves.

Take a closer look at how these shifts are reshaping the semiconductor landscape. -

Data Observatory

Hyperscaler investment remained a key growth driver, with Amazon, Microsoft, Google, and Meta continuing to boost capex despite a slight Q1 dip. TechInsights’ Industry Performance data stream reveals that Die Bank inventories came in lower than expected, while OEM IC stockpiles were higher—pointing to a possible tariff-driven supply chain shift. Economic uncertainty and expanding Chinese capacity continue to pressure pricing, with DAO manufacturers maintaining caution through lean inventory and disciplined production. -

Editorial: Insights from the 2025 Customer Satisfaction Survey

TechInsights’ 2025 Customer Satisfaction Survey collected over 28,000 responses, covering 46% of the chip market and 66% of subsystem customers. While large suppliers saw a modest dip in satisfaction—particularly in support and responsiveness—focused suppliers improved across every category. Software quality, user experience, and field engineering support saw notable gains. As designs grow more complex, vendors are adapting with more modular tools and tighter software integration. Advantest ranked highest overall, praised for strong partnerships and customer trust.

Explore the full survey insights and award winners. -

Company Profile: Advantest

Advantest ranked No. 1 in TechInsights’ 2025 Customer Satisfaction Survey for the sixth year in a row, earning five-star ratings in key areas including trust, technical leadership, and field engineering support. The company remains a leader in semiconductor test solutions, with strong customer loyalty across global markets.

In FY2024, Advantest reported ¥779.7B ($5.4B USD) in revenue—up 60% year-over-year—driven by high demand for AI-related test systems and strong sales in Taiwan. Its growing cloud-based ecosystem, including ACS Gemini and SiConic, supports AI/ML-driven analytics and silicon validation, integrated with top EDA tools.

Under new Group CEO Douglas Lefever, Advantest continues to expand its capabilities through strategic acquisitions, including Verigy, Essai, R&D Altanova, and Shin Puu Technology.

Get the full profile on what’s driving Advantest’s sustained leadership. -

Interesting Observations

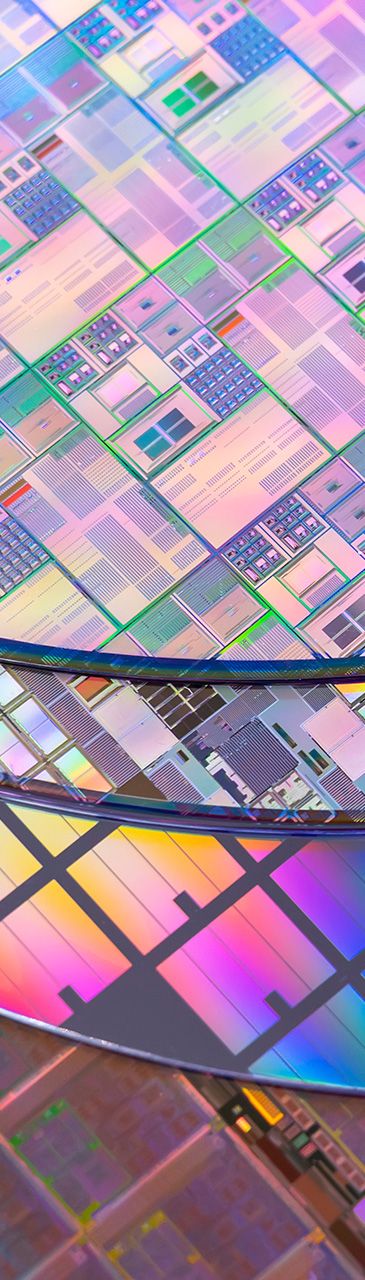

Hybrid bonding is emerging as a key enabler for true 3D system integration, offering superior performance and power efficiency over 2.5D solutions. While already in high-volume use for image sensors, broader adoption still faces significant technical challenges as the industry pushes toward scalable vertical integration.

In the SiC market, an influx of low-cost 6-inch wafers from Chinese manufacturers is driving commoditization, straining vertically integrated players like Wolfspeed. Weak EV demand, excess capacity, and delays in transitioning to 8-inch wafers are compounding the pressure. The May McClean Report update highlights shifts in market leadership, with CXMT debuting at No. 34 and Taiwan-based Winbond, Powerchip, and Vanguard returning to the top 50 at ranks 44, 47, and 48. -

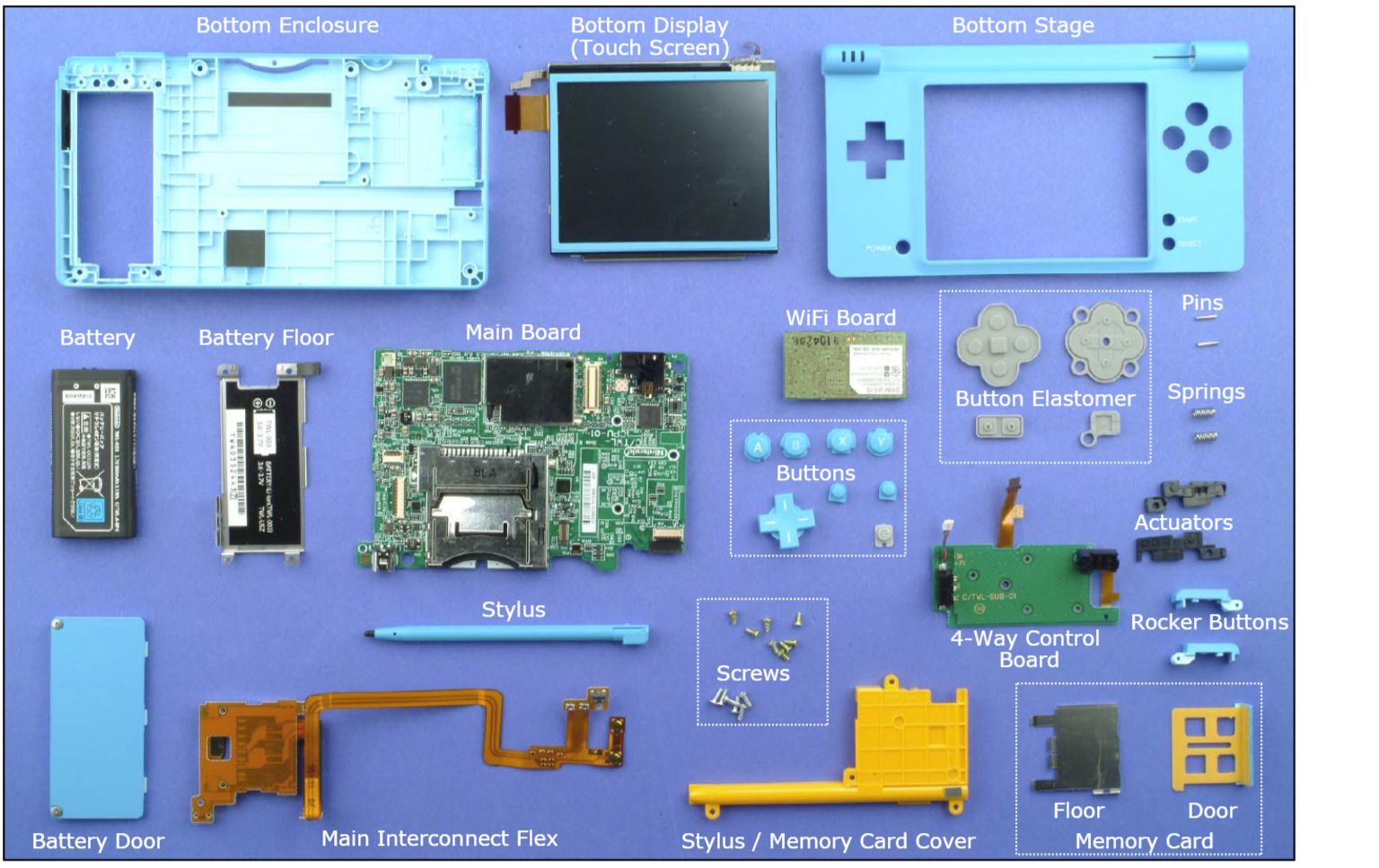

Retro Tech: Can you guess this device?

This handheld gaming upgrade featured dual cameras, a faster processor, and four times the RAM of its predecessor. Think you know which system it was? Test your knowledge in this month’s Retro Tech.

Industry Intelligence that Matters.

Access the full June 2025 Chip Observer—and stay ahead in the fast-evolving chip landscape.

*Registration is free and takes less than a minute. All you need is your corporate email to unlock industry-leading semiconductor insights.