Tracking the market for semiconductors, from the fab floor to the customer’s door.

Editor and Lead Author: David MacQueen

![]()

Industry Observatory

Tracking the key news stories.

Semiconductor market will recover in 2024, $1 trillion market in 2033

- 2024 will be a record year. By revenue, we expect that the integrated circuit (IC) market will grow by 17% year-over-year.

- We expect the double-digit growth in 2024 to continue out to 2026. The industry has not experienced three consecutive years of double-digit growth since 1993–1996.

- By 2033, we expect semiconductor revenues to double and exceed a trillion dollars.

Geopolitics: China takes memory lead; US sanctions tightened

- TechInsights discovered the world's most-advanced 3D NAND memory chip in a consumer device, and in a surprise technology leap, it came from China’s YMTC.

- US sanctions to mainland China extended restrictions to include deep ultraviolet (DUV) 5nm process tools if they include any US-made components, encompassing ASML’s current product range.

- US sanctions also restricted artificial intelligence (AI) chips by more stringent performance criteria. Nvidia is reportedly designing a new range to supply to China.

AI

- Amazon and Google launched new generative AI tools, Q and Gemini, respectively.

- Intel and Qualcomm’s latest range of PC chips focused on AI capabilities—more below.

PC chip architecture

- Intel began shipping its new range of chips focused on “AI Everywhere,” which include GPU cores aimed at optimizing AI performance.

- Qualcomm’s latest Snapdragon chips use an Arm-based architecture. As with Intel, the company focused on AI capabilities of its new range of chips.

Can Canon’s NIL tools provide ASML with competition?

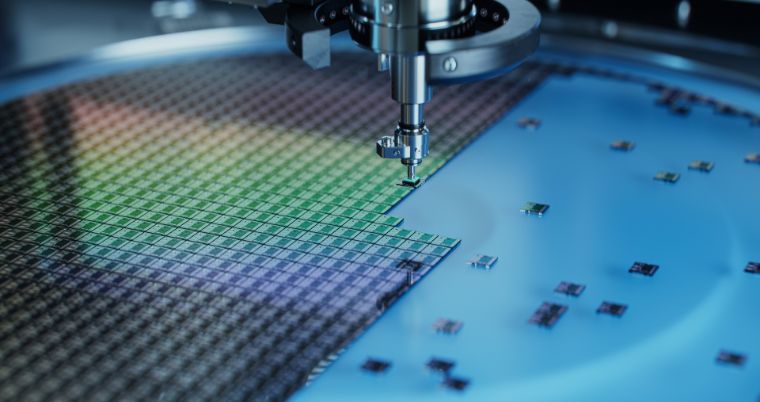

- Canon announced its new semiconductor tool using nanoimprint lithography (NIL), which it claims can address 5nm processes. Currently, only ASML produces lithography tools that can address 5nm or below. Canon is unlikely to break that monopoly since ASML has already progressed to 2nm processes.

![]()

Under the Microscope

The last couple of months in 2023 saw a lot of activity around the continuing megatrends of geopolitics and AI, but arguably the most immediate, impactful trend was the strengthening industry recovery and a renewed optimism from all players about the coming year. The PC chip market also saw some interesting changes that will set that sector up for a dynamic 2024. Finally, Canon generated a lot of interest with its announcement of lithography tools that can address 5nm processes.

2024 Semiconductor Market Rebound

After a very challenging couple of post-COVID years, the industry showed strong signs of growth at the end of 2023. We anticipate this recovery will continue into 2024, strengthening as time goes on and becoming a record year for total revenues. We expect that IC market revenues will grow by 17% year-over-year.

The longer-term industry outlook is discussed in the Data Observatory section.

Geopolitics

YMTC surprised with the world’s (not just China’s) most-advanced memory chip. 3D NAND memory represents the bleeding edge of memory chip design, and is critical for high-performance, high-bandwidth computing such as AI. However, the chip was manufactured on tools that Chinese companies can no longer purchase. Volume production will therefore be low, and the company can likely go no further down this technology path. Samsung and SK hynix are likely to overtake them soon and retain that leadership position.

US sanctions tightened, likely as a response to YMTC and the HiSilicon 7nm chips found by TechInsights in the second half of 2023. These extend restrictions to include deep ultraviolet (DUV) 5nm process tools if they include any US-made components, encompassing ASML’s current product range. The government of the Netherlands is yet to confirm if they will follow these sanctions.

The US also placed restrictions on AI chips. AI chips must fall below tightened thresholds of existing criteria for performance speed and bandwidth density as well as a new criterion—performance density. Nvidia has reportedly designed new, more limited, AI GPUs to fulfill the new restrictions.

Artificial Intelligence

OpenAI scored a spectacular own goal with the board ousting its CEO, who was subsequently hired the following day by Microsoft. Following pressure from staff (and the prospect of many employees following Sam Altman into the blue) the OpenAI board was forced to change. The renewed board managed to tempt Sam Altman back to OpenAI on the Monday following his Friday dismissal. ChatGPT itself could not have written a better soap opera script—but while it caused much gossip, the net impact is low, resulting in a relatively minor board reshuffle and a commitment to improve corporate governance.

Meanwhile, business continued as usual in a less dramatic fashion at OpenAI competitors. Amazon Q, a generative AI tool designed specifically for enterprise use, launched in November. Google, struggling with its Bard generative AI product, rolled out a new LLM (large language model), the technology that underpins generative AI, called Gemini Pro. Intel and Qualcomm both launched new offerings of PC chips focused on AI capabilities—more in the following section.

PC Chip Architecture

Intel began shipping its new range of chips that were created using its newest process, Intel 4, the second step of its “5 process nodes in 4 years” strategy. The new range focuses on “AI Everywhere” and includes GPU cores aimed at optimizing AI performance.

Intel will face growing competition in the coming year from completely new architectures. Qualcomm’s latest Snapdragon chips are also manufactured with a 4nm process, competing directly with Intel and outperforming them in some benchmarks. The chips use an Arm-based architecture—Windows on Arm is likely to become a reality in 2024. As with Intel, the company focused on AI capabilities of its new range of chips.

Canon NIL Tool

Canon announced its new semiconductor tool using nanoimprint lithography (NIL), which it claims can address 5nm (and potentially more advanced) processes. Currently, only ASML produces lithography tools that can address 5nm and more advanced processes. Canon is unlikely to break that monopoly. Even if Canon’s technology proves to be viable at 5nm, it’s likely to be too little, too late to compete at the cutting edge of semiconductor fabrication. That said, the benefits that Canon has been stating for NIL may give it some distinct advantages for certain processes.

![]()

Data Observatory

TechInsights’ at-a-glance health check on the pulse of semiconductor manufacturing.

As discussed above, 2024 will be a record year for semiconductor revenues. In future years, we expect double-digit growth in 2024 to continue out to 2026. The industry has not experienced three consecutive years of double-digit growth since 1993–1996. Then it was driven by early growth of the internet and the boom in home computing. This time, there are a combination of factors: AI, electric vehicles, replacement cycles of consumer electronics bought during lockdown, and the next wave of PCs after Microsoft ends support for Windows 10.

![]()

The long-term forecast remains cyclical, driven by device life cycles and the macroeconomy. There are many other challenges that the industry will face in the coming years. The geopolitical landscape is resulting in new capacity built most notably in the United States and the European Union, but the nature of semiconductor manufacturing means that there will be skills shortages in those regions. Sustainability, an increasingly important aspect of business for both semiconductor manufacturing and its customers, will necessitate change, which the industry must navigate. Manufacturing processes have developed to such a small scale that the limits of the laws of physics are being reached. New technology and process research is needed to maintain Moore’s Law.

By 2033, we expect semiconductor revenues to double and exceed a trillion dollars. To put that number in context, if the semiconductor industry was a country, it would be the world’s 20th-largest economy, slightly ahead of Switzerland. Little wonder that governments are investing to attract semiconductor companies as well as providing supply chain security across a huge range of products; it is an industry of rapidly growing economic importance.

![]()

Editorial

Automotive

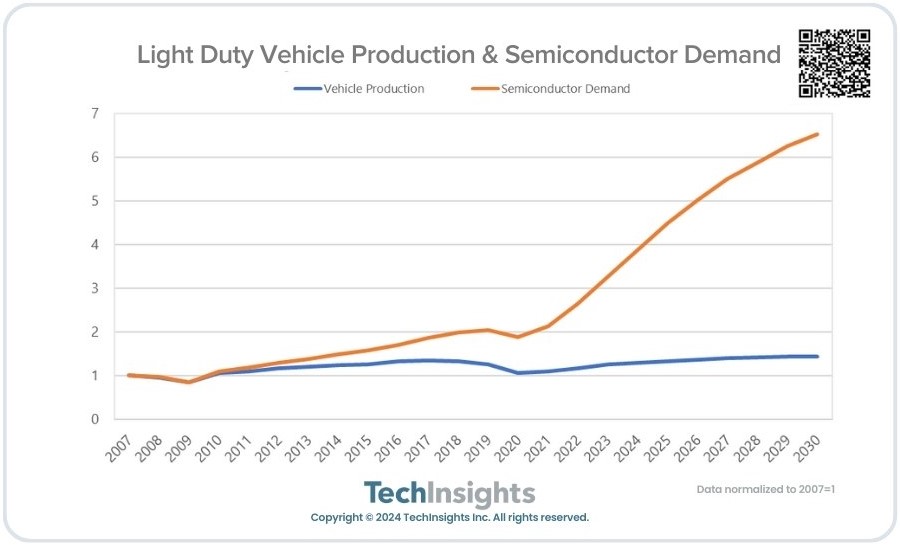

Something drastic is happening in the automotive world. Prior to 2019, growth in semiconductors demanded by the auto industry tracked vehicle production closely. After 2019, the demand for semiconductors explodes.

If you are thinking that this is due to the shift in the industry to electric vehicles (EVs), you’d be right—at least partly. Power semiconductors are indeed the main growth area, particularly those based on silicon carbide (SiC) and gallium nitride (GaN), which are more efficient than the purely silicon devices still in widespread use. The top 3 suppliers of semiconductors to the auto industry are Infineon, NXP, and ST which have long-standing relationships with auto OEMs. Growth in power semiconductors for EVs has favored the “incumbent” auto semi suppliers.

However, that only accounts for a fraction of this change. Beyond that small number of extra semiconductors per vehicle, there’s no fundamental reason why an EV requires radically more. So why is the semiconductor content of an EV twice that of an internal combustion engine vehicle? And what are the other market opportunities?

Software-Defined Vehicles

To make a successful EV to complete with Tesla, manufacturers can't simply replace the internal combustion engine with an electric motor. They have gone back to the drawing board and started again. We are seeing an unprecedented number of new vehicle platforms, and completely new vehicle architectures, which incorporate the latest technology. Advanced safety features, connectivity, infotainment, and driver monitoring are commonplace in EVs.

Qualcomm, AMD, and Nvidia have a very small market share in automotive today but are targeting the auto industry for growth. They are playing in the second-key growth area—high-end processors for driver assistance and infotainment functions. The auto system-on-chip (SoC) market will approximately double, and memory requirements closely track this growth. SoCs are also changing with new vehicle architectures. While the number of SoCs will double, the value of those semiconductors grows even faster as more advanced domain and zonal controllers replace stand-alone electronic control units (ECUs).

The advanced processors are leading the industry into its next wave of innovation—the software-defined vehicle. What does that mean? A smartphone might be considered a software-defined device—the apps you install and the OS upgrades change your experience of using that device. The Tesla Model S was the first software-defined vehicle, with over-the-air (OTA) updates.

An example of the benefits of this were seen early on. The Model S had issues running over road debris that could puncture the underside of the vehicle. An OTA update increased the ride height of the car, fixing a problem which for other manufacturers would have meant an expensive product recall. These OTA updates are enabled through connectivity, and Wi-Fi, 5G, and satellite modems are another growth area for in-vehicle semiconductors. That connectivity is also enabling another growth area in automotive—the rise of subscriptions.

Subscriptions—the Future of Mobility

One viewpoint on the automotive industry is that people are buying mobility, not a particular vehicle. Car subscription services can be viewed through this lens. They are becoming increasingly popular.

It is not only connectivity that is facilitating this change. With many new components and features, EVs tend to be more expensive to purchase, and consumer budgets remain constrained. Remote and hybrid working patterns change a vehicle from a daily necessity to an occasional need. Europe is the most-advanced region for subscriptions, with auto OEMs such as Renault and third-party providers like Sixt offering monthly subscriptions.

As well as subscriptions for access to vehicles (or subscribing to a ride-hailing service), auto OEMs are also offering subscriptions to additional services and in-vehicle features. These typically include features such as navigation or driver assistance. There is some resistance to this model, particularly from older age groups. An interesting case of a manufacturer taking this model too far was BMW’s heated seat subscription. The components are already in the vehicle but activating them required an $18 per month subscription. After negative press, BMW removed this subscription element.

Services like ride-hailing and robo-taxis take away the need for a consumer to own a vehicle. However, ride-hailing drivers are increasingly using car subscription services for their vehicles. Car OEMs and third-party car rental companies (such as Hertz) are increasingly partnering with ride-hailing services to provide packages aimed at drivers.

Perhaps the most-advanced example of this is DiDi, the world’s largest ride-sharing service. It first launched a dedicated ride-sharing EV in 2020 in conjunction with Chinese auto OEM BYD. The vehicle is leased to DiDi drivers. The company recently finalized a deal with another auto OEM, Xpeng, which will see a second DiDi EV launch next year, again only for lease to its drivers. As part of the deal, Xpeng will acquire DiDi’s existing smart car unit, and DiDi will take a stake in Xpeng. Subscriptions and ride-hailing are shaking up the auto OEM landscape.

Autonomous Driving

The buzz around autonomous driving started early. All Tesla cars since 2014 have supported the Autopilot mode, and at the time the company predicted full autonomy by 2017. At the time, other car manufacturers made more cautious projections of 2020, but those have proven similarly optimistic. Full autonomy has been a stubborn nut to crack.

Although fully autonomous driving remains in the trial phase, progress has been made in intermediate levels of autonomous driving and these features are integrated into vehicles today. Level 0 features are limited to warnings and momentary assistance, such as automatic emergency braking. Level 1 provides steering or brake or acceleration support to the driver. Level 2 (such as Tesla Autopilot) offers simultaneous steering and braking to the driver.

Level 3 is the first level at which the human in the driver’s seat is no longer responsible for continually supervising the automation—but they may be asked to retake control if the automation can no longer operate safely. The first commercially available level 3 vehicle was the Honda Legend, launched in 2021. The SENSING Elite autonomous functions are limited to use in traffic jams only and in Japan only. Mercedes-Benz followed with the DRIVE PILOT system in 2022; this is restricted to use only on dedicated stretches of the autobahn network in Germany.

Levels 4 and 5 require no human input or supervision at all and open new markets such as robo-taxis. There has been progress—TechInsights is tracking over 200 trials worldwide—but the mass market is yet to emerge.

While fully autonomous driving may remain some years away from mass adoption, the technology to achieve this is already being built into vehicles today and providing opportunities for the semiconductor industry. These opportunities are not limited just to the additional sensors and onboard AI capabilities of the vehicle itself. Autonomous driving includes a strong AI cloud element. While in use the vehicle relies on its own AI; it will feed what it has “learned” up to the cloud so that systems are improved with real-world data from an entire fleet of vehicles. Autonomous driving may have been overhyped, and having a bumpy ride today, but it is on its way. The opportunities once it hits the mass market are significant.

![]()

Company Profile

Observing Sony

What do James Bond, Bob Dylan, and the world’s bestselling smartphone image sensors have in common? They are all part of Sony’s end-to-end approach to the creative industry. A major technology and media company, Sony’s diverse media interests in the fields of movies, gaming, and music are supported by the company through devices for content consumption and creation, right down to components.

Sony in Numbers

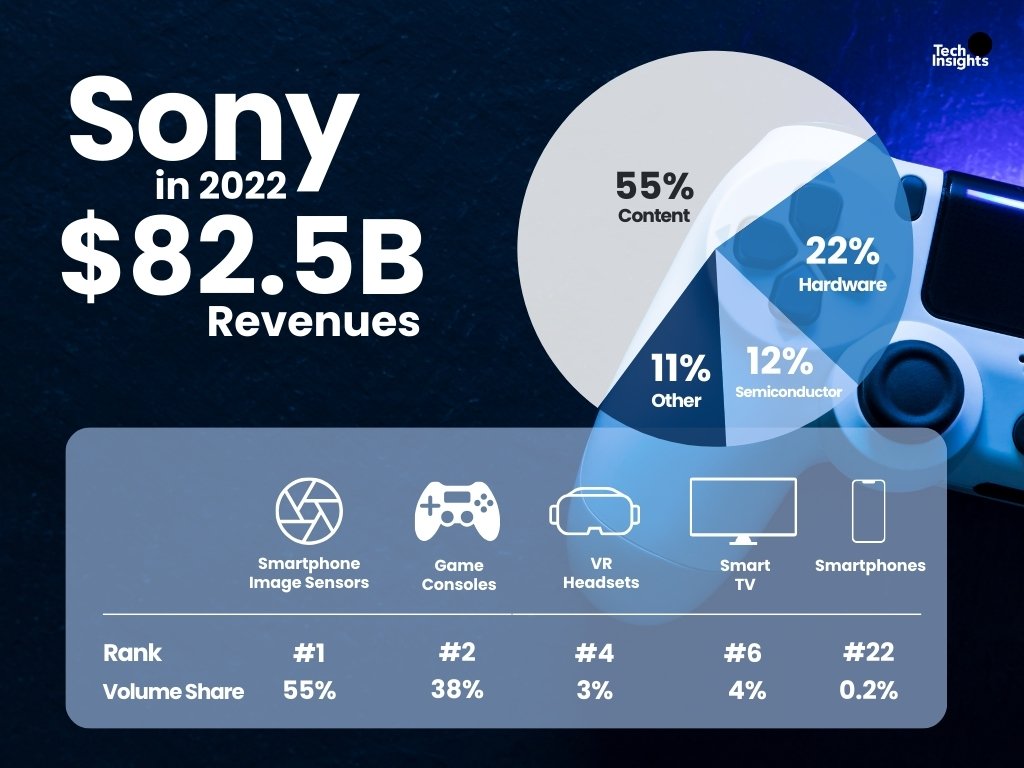

Sony posted revenues of $82.5B (¥11,540B) in 2022. Most of its revenues come from these three main categories.

Content: Sony Pictures for movies and TV, Sony Music, and Sony Interactive Entertainment, which also distributes both its PlayStation consoles, virtual reality hardware, and games software. $47.5 billion revenue FY 2022

Hardware: Sony Corporation and Sony Electronics create hardware for both the consumption of this content by consumers and its creation by professionals. These include TVs, smartphones, cameras, and audio equipment. $17.7 billion revenue FY 2022

Semiconductor: Sony Semiconductor Solutions primarily manufactures imaging sensors and display components for its own and competitor devices. $10.0 billion revenue FY 2022

Sony’s Web

Through its diverse business interests, Sony has spun a web through the media industry worthy of featuring in one of its Spider-Man movies.

If you are consuming media, the chances are that Sony is involved—and has generated some revenue. There is the revenue from the content itself, depending what movie you’re watching or what you’re listening to. There is the physical equipment (or its components) used in media production and the device you are using to view or listen.

Sony is also one of the top-10 patent holders globally, with around 100,000 patents; its influence extends beyond even the devices it builds itself or builds components for. An interesting example of this is Blu-ray. Sony is one of the key patent holders for this media format.

Sony leveraged its diverse business interests alongside its patents to ensure its success. Blu-ray won against the competing HD DVD format in part due to Sony’s incorporation of a Blu-ray player into PlayStation consoles, starting with the PlayStation 3 in 2006. Those devices became a “Trojan Horse” into consumer’s living rooms and ensured Blu-ray’s success.

Some businesses are quite distinct from its technology and media empire. Most “other” revenues in 2022 came from its financial services business. Over the years, Sony has also been involved in the chemical industry (Sony Chemicals was divested in 2012) and even launched a restaurant.

Other than the financial services, most of the company’s other activities are related to its imaging business. For example, in healthcare, Sony provides medical imaging equipment. Its range of robots, which started as the AIBO robot dog in the 1990s, has evolved into models with greater utility, such as a surveillance drone equipped with Sony cameras.

The Future Vision of Sony

One of Sony’s most recent ventures takes the company into a completely new sphere. In a partnership with automotive company Honda, Sony Honda Mobility will see the first of its AFEELA range of vehicles roll off the production line in 2026. The concept electric car shown at CES 2023 was packed with 45 Sony cameras and sensors to enable level 3 autonomous driving. It will be almost a moving showroom for Sony’s imaging products.

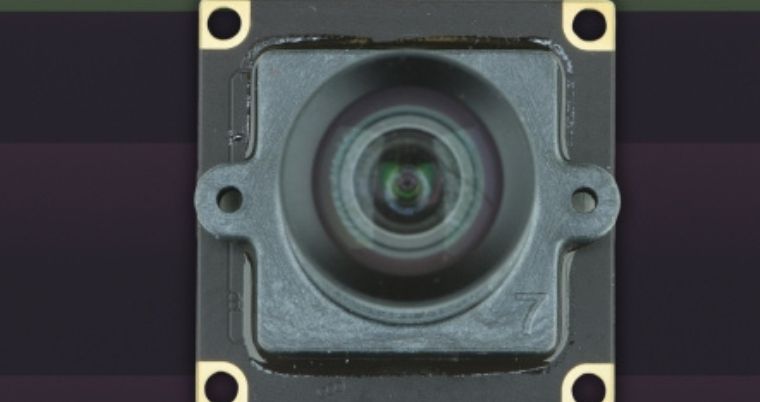

Sony’s particular area of strength is in image sensors. It is not just conventional cameras where Sony has a lead. The company’s LiDAR-on-chip solution is almost revolutionary. LiDAR is typically used in vehicles as most solutions are bulky and include a spinning dish, much like a radar you might see on top of an air traffic control tower.

Sony managed to make LiDAR work on a single chip with no moving parts. Its LiDAR-on-chip solution generated a lot of interest when it was integrated into iPads and iPhones in 2020. We believe that this is used in the Apple Vision Pro to enable spatial computing and gesture tracking (this will be confirmed in a later TechInsights’ teardown when the device is available in February 2024).

Sony has integrated AI computing onto image sensors, starting with the IMX500 in 2023. High-speed, on-device edge-AI computing capabilities will enhance augmented reality (AR) and autonomous driving applications.

Sony is well positioned for a future role in spatial computing. The first step in augmenting reality is understanding reality. Sony’s range of imaging sensors featuring advanced functionality such as on-device AI computing integrated onto the image sensor, and on-chip LiDAR give it a strong component play. OLED is the leading technology for AR headsets today, and Sony is also a supplier of these components.

Its spatial computing devices range from the PSVR2 headset (launched early 2023) right up in scale to an entire electric vehicle. Sony’s pervasive role in media today may become a pervasive role across the entire digital world tomorrow.

![]()

Interesting Observations

Curated highlights of the top reports published on the TechInsights platform in the past month.

This month we highlight predictions for the coming year in both processor technology and the consumer electronics market. We also recap the top news from CES 2024. These reports are available free in the TechInsights Platform (registration required).

Analyst Predictions for 2024: As 2024 begins, Microprocessor Report is looking forward to this year’s developments. We’ve picked three areas in which we see substantial activity: CPUs, AI, and processor-adjacent technologies (Compute Express Link and chiplets). Opinions draw from our prior coverage and statements from vendors as well as general trends, the rumor mill, and our collective gut.

Consumer Electronics Industry Revenues to Exceed $1 Trillion in 2024: Global consumer electronics market revenues are set to break through the one trillion-dollar barrier in 2024. This is a significant milestone for the industry and comes at a time of pivotal change and innovation. At CES 2024 we witnessed the transformative potential of technologies such as AI as companies adapt to rapidly changing consumer needs and preferences. This will set the scene for the year ahead, which we forecast to be a positive one for the industry as key product categories see a return to growth amid a rosier economic outlook and a less-disruptive supply chain.

TechInsights at CES 2024: TechInsights’ leading analysts specializing in consumer electronics, automotive, and mobile were on the ground at CES and shared firsthand insights on the top technology trends emerging in the consumer electronics realm in 2024 and beyond.