Trump Approves H200 Exports to China: What It Means for NVIDIA, TSMC, and the HBM Market

3 Min Read December 16, 2025

TechInsights analysis explores potential supply chain bottlenecks that will determine whether unconstrained demand of $40-50B can be met.

The performance difference is massive.

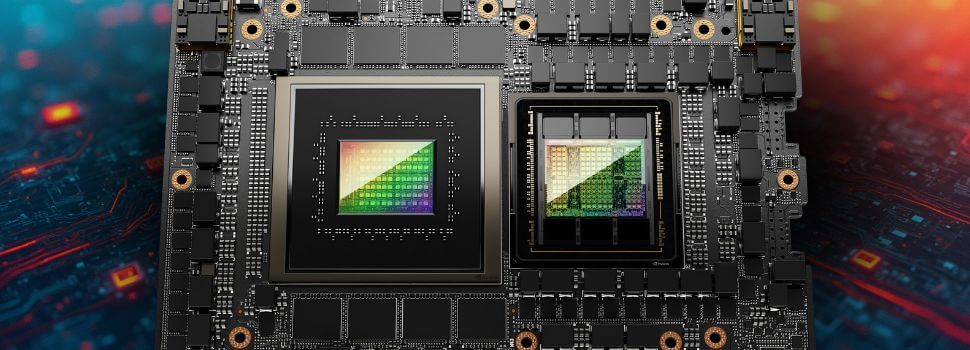

The H200 delivers 13x the compute performance of China-specific H20 chips, with 3,958 TFLOPS versus 296 TFLOPS. But technical superiority doesn't guarantee market success.

The supply chain dynamic.

In this supply-constrained environment, incremental China demand competes directly with existing customers. This could enable NVIDIA to raise ASPs enough to offset—or exceed—the 25% surcharge, effectively passing compliance costs to customers while preserving margins.

Get the full analysis.

TechInsights’ full analysis goes deeper, including unconstrained demand modeling and unit forecasts, TSMC N4 wafer and CoWoS packaging capacity assessments, HBM3E supply dynamics and expansion timelines, and competitive positioning versus Chinese domestic alternatives. The report also examines market-clearing price implications as global customers bid against one another for limited GPU and HBM supply.

Unpack the Real Constraints Behind the $50B Demand Surge

Explore detailed forecasts for TSMC wafers, CoWoS, and HBM3E—plus competitive responses in China’s AI ecosystem.

Create your free account using your corporate email above and start exploring the TechInsights Platform right away. Certain report content may be accessible only to subscribers.