Semiconductor Sales Take a Deep Dive

October 13, 2021

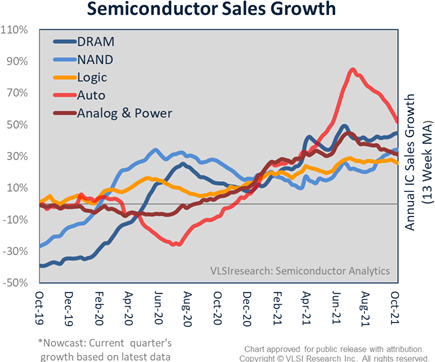

Semiconductor sales took a deep post-September dive last week. Though still above 2020, it was weaker than expected seasonality. Semiconductor Sales by segment were depressed as the hyper-jump off 2020's low bar began to tail off. Still, 13-Week moving averages are in the 20-to-50% range, with Auto ICs at the top followed by DRAM, NAND, Analog & Power, and Logic. Memory and Logic remain in an upward growth trend, indicating the upturn is in place. Slowing growth for Auto and Analog & Power is the morning hangover after the shortage. IC sales will close the year out close to $0.5T and Logic $1⁄4T.

The IC weather warmed 1°F last week. VLSI's IC Supply/Demand indices held at Tight last week with NAND & More-than-Moore Foundry improving a notch. There were slight improvements in DRAM and More-Moore Foundry, with no change in IDM and Analog & Power. OSAT and Auto were weaker. The 3Q21 Supply/Demand NowCast closed out in Balanced conditions.