Posted: October 12, 2016

Contributing Authors: John Sullivan

UPDATE October 27th 2016: Today Qualcomm announced a definitive agreement to purchase NXP. This acquisition instantly positions Qualcomm highly in the automotive market, in direct competition with Texas Instruments (rumoured to be amongst alternative bidders for NXP). This leaves us musing on the acquisition potential of the other big semiconductor automotive players – Infineon, Renesas and STMicro. It appears that the recent trend in semiconductor M&A is set to continue.

Read on for an analysis of what this acquisition means to the patent portfolio of Qualcomm.

Recent reports have surfaced suggesting that Qualcomm is in discussion to acquire Dutch chipmaker NXP. Such a deal, likely valued at over US$30B, would be one of the biggest in the semiconductor sector this year and would push 2016 closer to the total acquisition record set just last year, which was in excess of one hundred billion dollars.

A History of Qualcomm M&As

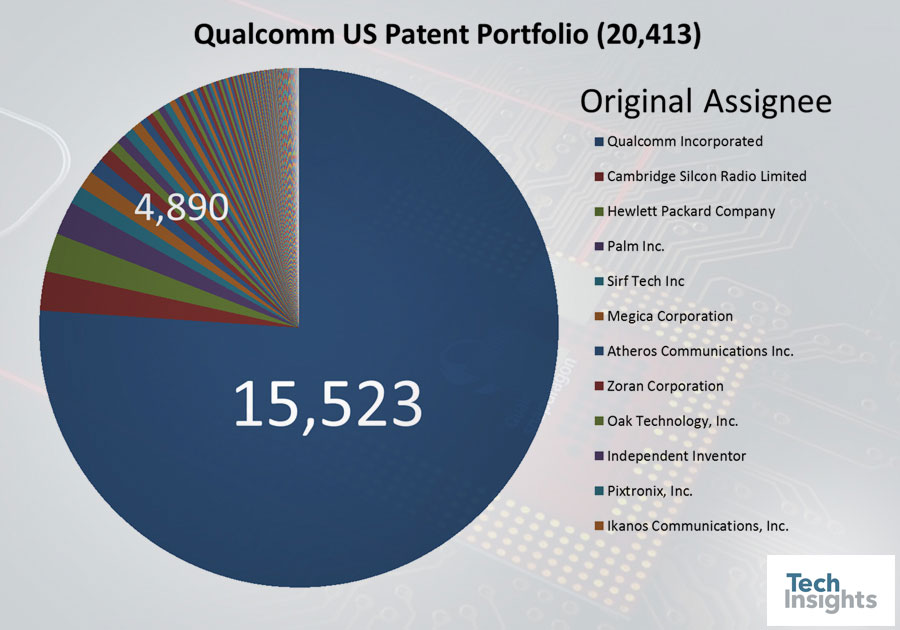

A look into Qualcomm’s history reveals that they have been quite active in mergers and acquisitions. Since 1997 there have been at least 40 acquisitions on record, with details disclosed for 19 which themselves totaled US$8.4B. Notables would have to be the acquisition of Atheros in 2011 for US$3.1B and Cambridge Silicon Radio (CSR) in 2014 for US$2.5B. These acquisitions could be seen as a means to stimulate growth in existing and emerging markets. Atheros was a developer of communication semiconductors targeting Wi-Fi networking, while CSR was a UK-based company with products that dealt with Bluetooth and Wi-Fi for automotive, audio, and the Internet of Things (IoT). Both companies were fabless, as is the case for their purchaser. Qualcomm has also grown their patent licensing business, which earned approximately US$8B in 2015, by adding patent assets to their already large portfolio. There was a significant acquisition of 2,400 patent assets from Hewlett Packard in 2014. In fact, a closer look at Qualcomm’s portfolio of over 20,000 granted US patents reveals that almost 25% has been acquired through acquisitions of other companies or through strictly patent transactions.

Growth Through Acquisition At Its Finest

On September 29, 2016 multiple sources reported that Qualcomm was in talks to acquire NXP for US$30B. If this acquisition does indeed go through, then it will be the ultimate example of growth through acquisition. It will be one of the largest acquisitions in recent years and will lift Qualcomm to the 3rd largest semiconductor company in the world with revenues around US$27B. Qualcomm would go from being a fabless semiconductor company to one having wafer fabrication facilities in the United States, the United Kingdom, Germany, Singapore, and the Netherlands. Perhaps most interesting is the fact that when NXP acquired Freescale last year they became the #1 player in the automotive semiconductor market. If Qualcomm acquires NXP they would instantly go from being ranked 34th in the automotive semiconductor market, according to Gartner in 2015, to #1. Their product line would diversify immensely. They would expand from being a leader in processors and radio frequency (RF) (Wi-Fi, Bluetooth, and cellular) products to having a broad suite of product types including microcontrollers, discrete components and logic, power management, RF, sensors and automotive products.

The IP Benefit

Another benefit of this potential acquisition is the boost in intellectual property assets.

If we examine Qualcomm’s patent portfolio as it stands now versus what it would look like after the acquisition we can see the potential implications.

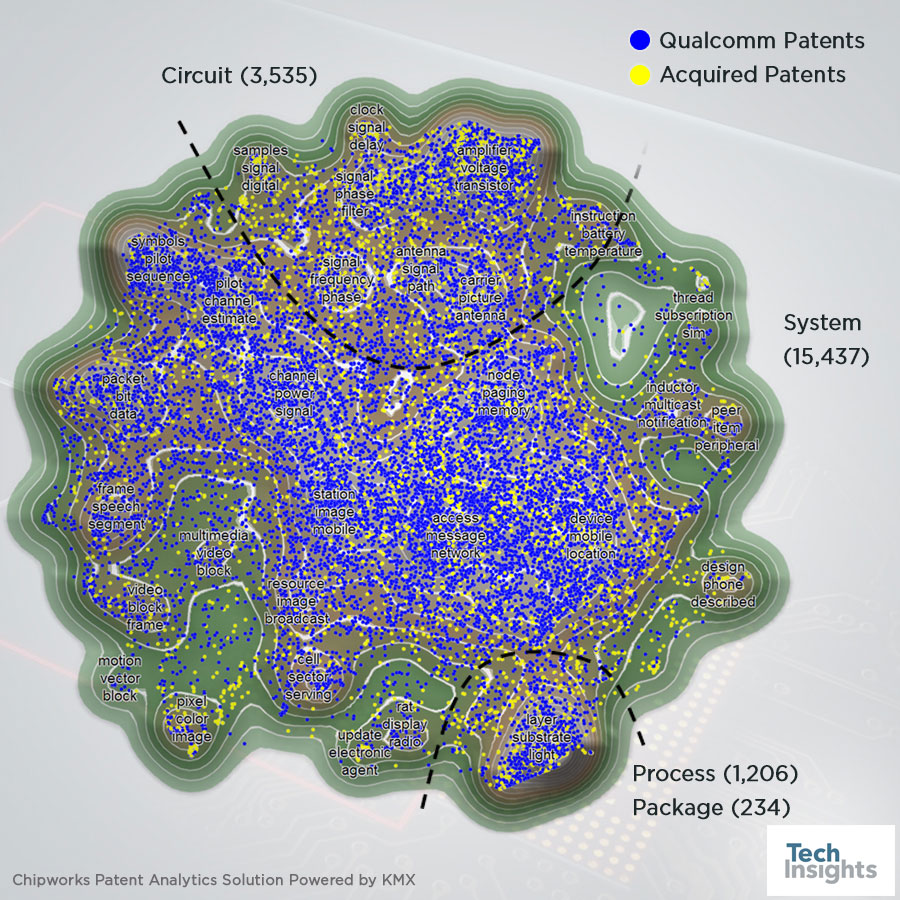

The analysis was aided by Chipworks’ Patent Analytics Solution powered by KMX, which allows us to create graphical representations (landscapes) of patent portfolios. All patent documents in a landscape are represented by a coloured dot. Patents with similar text are grouped together. Topographical peaks denote key technology concepts and the top three most frequently used words for each peak are shown.

Qualcomm's Current US Patent Portfolio Landscape

Qualcomm’s current US patent portfolio consists of 20,412 assets. As stated earlier, a quarter of these assets (4,889) have an original assignee other than Qualcomm. There are over 200 different original assignees in this portfolio. This indicates that not only is Qualcomm a prolific inventor itself but it also readily acquires assets to further its goals. The landscape below shows how Qualcomm’s original portfolio and the portfolios that they have acquired in the past complement each other. The areas of concentration on the landscape and the general distribution of the patents indicate that the acquired patents enhance Qualcomm’s patent position in their traditional areas of focus.

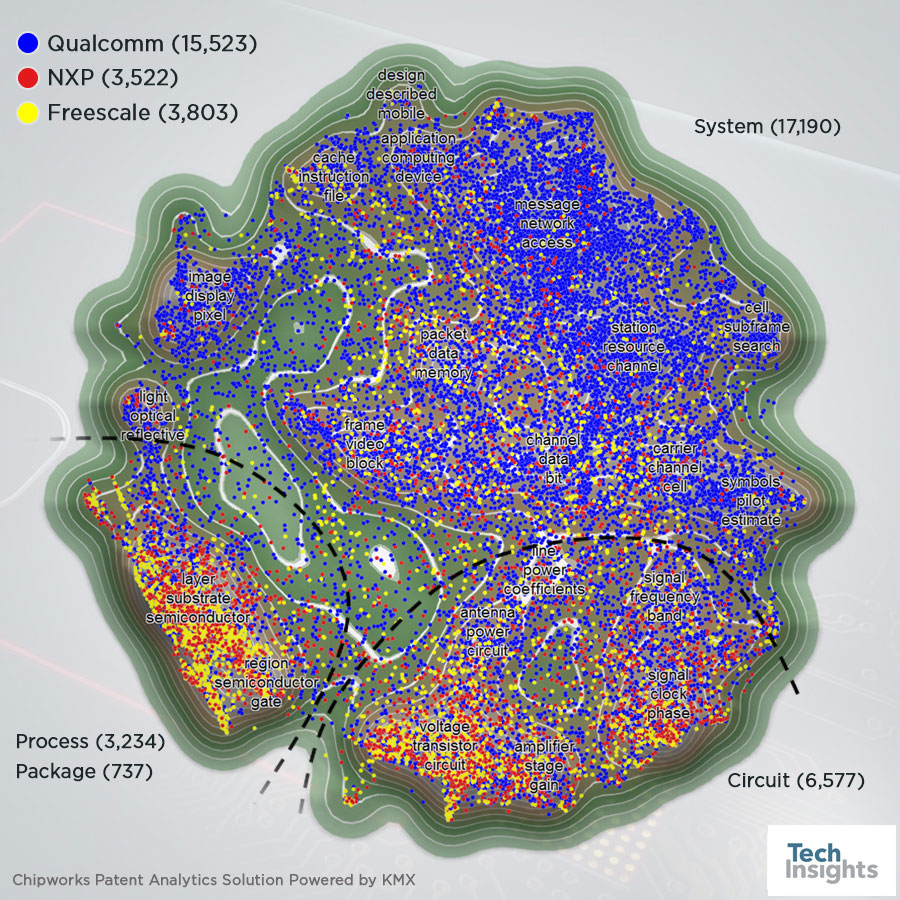

Adding NXP to Qualcomm's Patent Assets

Now, if we consider the combined portfolio of Qualcomm and NXP the landscape changes. The NXP portfolio, which includes a number of original assignees other than NXP as well, consists of 7,325 US patents. The landscape below shows the NXP (painted in red) and Qualcomm (painted in blue) portfolios mixed together. Freescale is highlighted as well (painted in yellow) as they are a major contributor to the NXP portfolio. It is evident from the landscape that the NXP portfolio is heavily focused on process/package and circuit assets. This is not surprising given the nature of NXP’s business.

If you also consider how the two portfolios overlap on the landscape, or rather don’t overlap, it becomes evident that NXP/Freescale patent assets cover areas that complement the existing Qualcomm portfolio, while also diversifying the portfolio into new areas.

In conclusion, if this acquisition goes through, (which is not guaranteed with rumours suggesting other significant players such as Intel and Texas Instruments may be actively pursuing NXP as well), this will allow Qualcomm to grow into other markets other than the maturing markets that it is already well established in. They will also be armed with an additional 7,325 US patent assets, allowing them to look for potential licensees that they may not have been able to consider with their existing portfolio. All-in-all, this would be a very beneficial acquisition for Qualcomm that would definitely cause a stir in the semiconductor industry.