Chip Observer May 2025

Navigating Geopolitics, AI, and Semiconductor Innovation

From shifting tariffs and bold AI investments to breakthrough chip designs and industry shakeups—get exclusive insights shaping the future of semiconductors.

6 Min Read May 23, 2025 Access the Full Report

Welcome to the May 2025 edition of Chip Observer, your go-to source for the latest developments transforming the semiconductor industry. This month, we dive into the powerful intersection of geopolitics, artificial intelligence, and cutting-edge manufacturing advancements. From easing U.S.-China tariffs and South Korea’s $35 billion semiconductor investment to revealing TSMC’s innovative packaging in NVIDIA’s newest GPU, the industry is in a state of dynamic change.

Notably, SanDisk has re-emerged as an independent player after its spin-off from Western Digital earlier this year, navigating a challenging NAND Flash market amid shifting consumer and enterprise demands. With major leadership shifts at Intel and STMicroelectronics, plus bold moves by emerging AI players in the Middle East, there’s no shortage of stories shaping the future of chips and technology.

Curious to learn how these trends will impact supply chains, market growth, and innovation? Read on—or log in to access the full analysis and exclusive data insights.

What’s Inside the May 2025 Issue

Industry Observatory

Key developments across geopolitics, AI, and manufacturing are reshaping the chip industry.

From tariff reductions between the U.S. and China to South Korea’s $35B semiconductor funding push, geopolitical shifts continue to impact global supply chains. In AI, Saudi Arabia’s HUMAIN venture made headlines with multi-billion-dollar deals, while TechInsights uncovered TSMC’s CoWoS-L in NVIDIA’s Blackwell GB100. Meanwhile, Intel and TSMC revealed progress on advanced nodes, and major organizational shakeups hit Intel, STMicroelectronics, and NXP.Under the Microscope

From shifting tariffs to AI investments, the semiconductor world remains in flux. This month’s update dives into the latest U.S.-China tariff adjustments, South Korea’s multi-billion-dollar boost to its chip sector, and Intel’s internal shakeup under Lip-Bu Tan. We also break down NVIDIA’s Blackwell GB100, featuring SK hynix’s HBM3E and TSMC’s CoWoS-L—plus Saudi Arabia’s bold push into AI and datacenters.Data Observatory

Inventory trends hint at strength—but caution remains. Q1 2025 saw stronger-than-expected inventory digestion as companies raced to front-load orders ahead of looming tariffs. The inventory-to-billings ratio is improving, fueled by a 23% YoY surge in IC sales and strong AI demand. While Q2 looks promising with seasonal restocking, questions remain about whether this momentum can last through the second half of the year.

Track trends before they become headlines.Editorial: The Future Is (or Must Be) Repairable

Tariffs are making electronics more expensive—and repairability more essential. With the Trump administration’s tariffs pushing prices up, consumers are holding onto devices longer, turning to refurbished tech, and demanding repair options. From Microsoft’s repairable Surface redesign to Fairphone’s ethical modularity, a global shift is underway. The right to repair isn’t just a legal issue—it’s a business opportunity.Company Profile: SanDisk

Reborn from the 2016 merger with Western Digital, SanDisk re-emerged as a standalone public company in early 2025, following pressure from activist investor Elliott Management. The move reflects shifting industry dynamics: SSDs have overtaken hard drives in consumer devices, leaving hard drives primarily in datacenter applications.

Now solely focused on NAND Flash, SanDisk faces a challenging landscape—flat NAND revenue growth, increasing DRAM dominance, and the potential need for consolidation. In fiscal Q3 2025, SanDisk posted $1.695B in revenue—its first quarter post-spin-off—marking a 10% sequential decline.

With a history that stretches back to pioneering SSDs and CompactFlash cards in the early 1990s, SanDisk now stands at a crossroads. Will it stay independent, merge with longtime partner KIOXIA, or diversify beyond volatile NAND markets?

Full company profile and revenue breakdown available to TechInsights subscribers.Interesting Observations

TechInsights continues to surface some of the most thought-provoking insights in the semiconductor industry. One standout moment? A TechInsights commentary likened China’s pursuit of a homegrown EUV solution—via laser-induced discharge plasma (LDP)—to a “DeepSeek moment” in lithography. The claim: LDP could be simpler, more efficient, and vastly more powerful than ASML’s current High-NA systems. If accurate, it’s a clear signal of China's accelerated progress in advanced chipmaking.

Meanwhile, the global SoC market surged to $354B in 2024—up 24% year-over-year—driven by AI in datacenters. With AI, automotive, and edge computing continuing to expand, TechInsights forecasts a healthy 7% CAGR for SoCs through 2030. Also covered: the May 2025 McClean Report highlights Q1 2025’s industry turbulence and adjusts forecasts accordingly—factoring in trade disputes, tariffs, and shifting alliances.Retro Tech: Can you name this quirky, short-lived device?

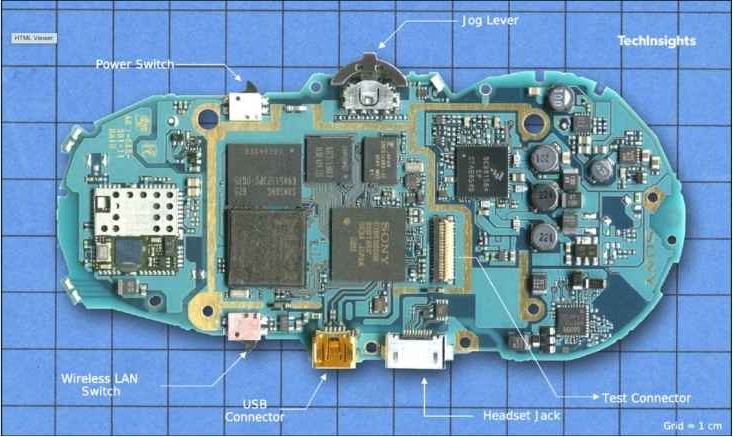

It launched with built-in Skype support—just as the service was peaking—but its Wi-Fi-only design left it stranded in a world quickly going mobile. Within a year, the iPhone made it obsolete. Think you know the model? Log in to reveal the answer and test your tech history knowledge with more Retro Tech moments.

Think you know the model? Log in to reveal the answer and test your tech history knowledge with more Retro Tech moments.

Industry Intelligence that Matters.

Access the full May 2025 Chip Observer—and stay ahead in the fast-evolving chip landscape.

*Registration is free and takes less than a minute. All you need is your corporate email to unlock industry-leading semiconductor insights.