Posted: May 10, 2016

Contributing Authors: Ray Angers

Just three months after the formation of Broadcom Limited, the first large organizational change came recently with the announcement that the newly formed entity was selling its wireless Internet of Things (IoT) business to Cypress Semiconductor Corp. This news provided the motivation for Chipworks to take a look at the patent landscape of the new Broadcom and try to determine what intellectual property (IP) might be associated with this transaction.

A bit of background on Broadcom and Avago

On February 1st this year, Broadcom Limited was created. The new company combines Singapore-based Avago Technologies and California’s Broadcom into a communications semiconductor powerhouse.

In the agreement announced in May 2015, it was reported that Avago was buying Broadcom Corporation in a $37 billion cash and stock deal. One would expect many negotiations would be involved when two large companies such as these join forces, and that was likely the case here. When the deal closed, Avago’s website was revised to announce Avago Technologies is now a Broadcom Limited Company. Avago’s English Wikipedia page re-directs to the entry for Broadcom Limited (the Broadcom Corp. entry remains). Interestingly however, the new Broadcom Limited is traded under Avago’s AVGO Nasdaq ticker symbol and is headed by former Avago CEO Hock Tan.

Avago was formed back in 2005 from Agilent’s Semiconductor Division which traces its lineage back to Hewlett-Packard. Avago grew in 2014 with the acquisition of LSI in 2014, which had previously acquired Agere Systems, whose origins trace back to Lucent/AT&T. Avago was a diverse company with products used in communications and storage networks.

Broadcom Corp., formed in 1991, as a fabless semiconductor company offering leading-edge products targeting the wireless and broadband communication sectors.

A closer look at the combined Avago/Broadcom patent portfolio

A closer look at the combined Avago/Broadcom patent portfolio

Both Avago and Broadcom Corp. bring sizable patent portfolios to the newly formed company. The majority of publications for both companies were filed in the US. Using the TechInsights Patent Analytics Solution Powered by KMX, we generated a patent landscape for the combined Avago/Broadcom patent portfolio, which consists of almost 22,000 active US grants and 1,800 applications.

Each dot on the landscape below represents a US patent grant or application (Broadcom Corp. painted blue and Avago in orange). The text algorithm built into KMX attempts to group patents similar in concept together on the landscape. Topographical peaks denote key technology concepts, with the top three most frequent words for each peak shown.

What initially jumps out is the large area at the bottom of the landscape populated predominantly by Avago patents. These are related to process and packaging technology and it comes as no surprise that the fabless Broadcom has little presence in this region.

Above this area it appears as though the Avago patents continue to dominate, however that is not the case. Display order resulted in the Avago publications obscuring the view of the Broadcom patents below. In fact, almost 60% of the patents in this area are assigned to Broadcom.

Circuit patents generally reside at the upper right area of the landscape. Keywords such as oscillator, mixer, clock, amplifier, and filter point to that fact. Circuit patents specific to memory applications are also found on the opposite side of the landscape, near the location labeled memory/bus/address. More than half of the patents in this combined portfolio are systems-related and span the entire landscape above the lower process cluster. IP developed for memory, storage systems, wireless networks, and data communications is found here, with some smaller technology clusters located around the periphery.

Broadcom’s Wireless IoT Business

Broadcom’s Wireless IoT Business

According to the April 28th press release, Cypress would acquire Broadcom's Wi-Fi, Bluetooth, and Zigbee IoT product lines and intellectual property, along with its WICED™ brand and developer ecosystem for $550 million in cash. The business unit generated $189 million in the previous 12 months, negligible when compared to the $8.4 billion total revenue reported by Broadcom Corp. in 2014.

By searching for keywords related to wireless IoT technology and accounting for patent families, we identified approximately 470 US grants and applications which we think could potentially be transferred to Cypress in conjunction with the deal announced. Displaying only these assets shows that those identified are located in the upper portion of the landscape where the systems and circuit patents are found. Not surprisingly, most of the patents identified originated from Broadcom Corp.

IoT Products

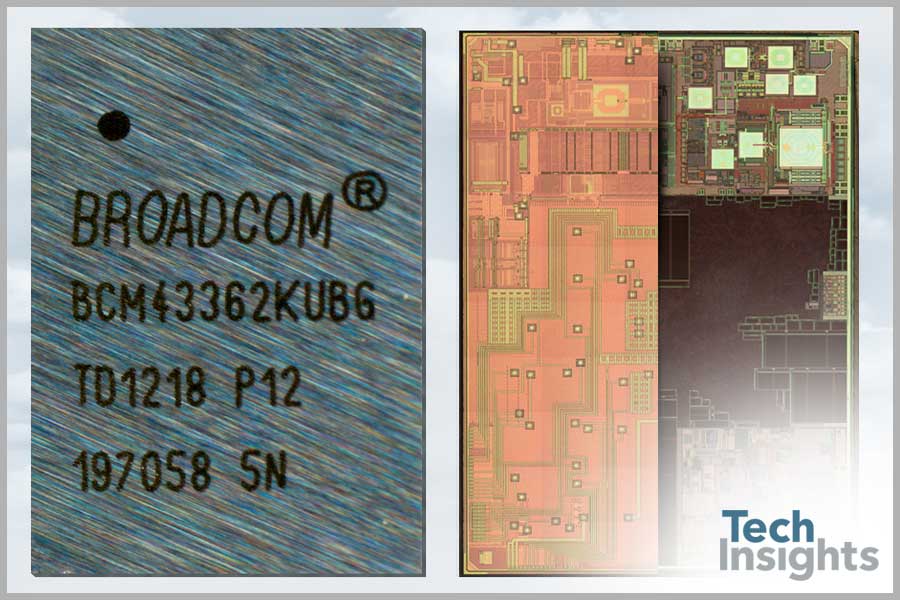

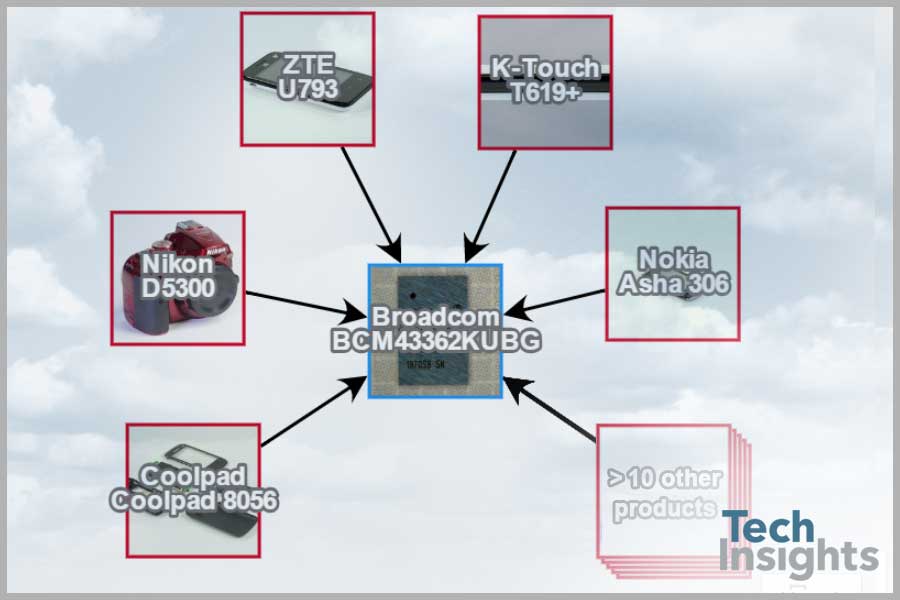

We are also interested in seeing which Broadcom products may go to Cypress when the business unit transfer is completed. The BCM43362 single-chip IEEE 802.11b/G/N MAC/Baseband/Radio is one product that comes to mind. Using Inside Technology, we have identified numerous socket wins for this component, including handsets, cameras, tablets and game consoles. Broadcom solutions are often found in Murata modules. Murata is one of many device suppliers identified on Broadcom’s partner community list.

Conclusion...

The transfer of this business will allow Cypress to offer a complete IoT design platform, while letting Broadcom focus on its wireless connectivity solutions for the access and mobility segments (set-top boxes, wireless equipment, personal computers, and smartphones). We will know for sure what Cypress is getting after the deal closes, with the expected completion date sometime in Q3 2016.